Vaca Muerta Oil Production Data

Latest Vaca Muerta oil production data, analysis and forecasting.

Enverus Prism provides essential up-to-date basin maps, rig counts, oil lease data, drilling and well production information for energy traders, financiers and E&P operators.

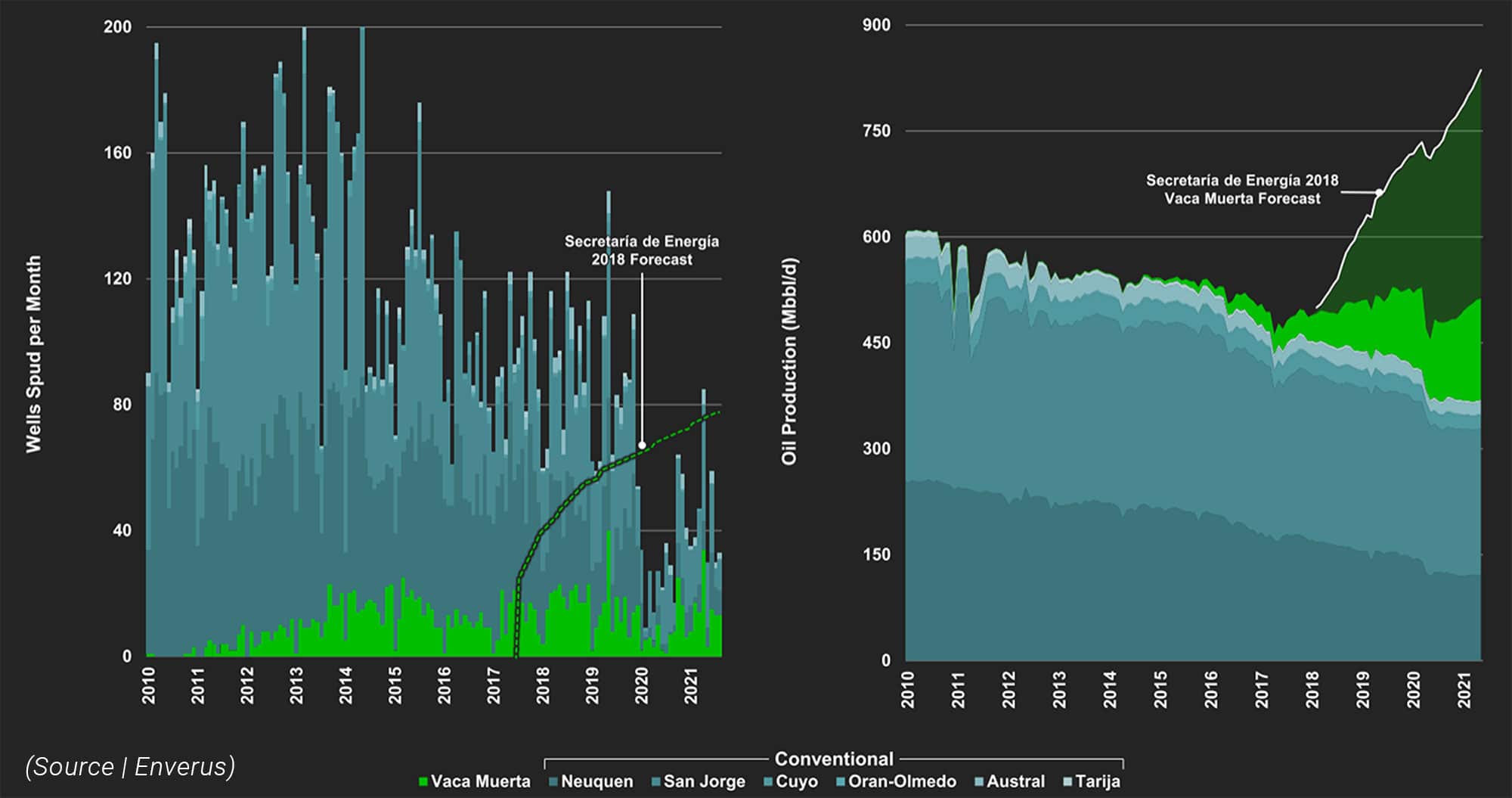

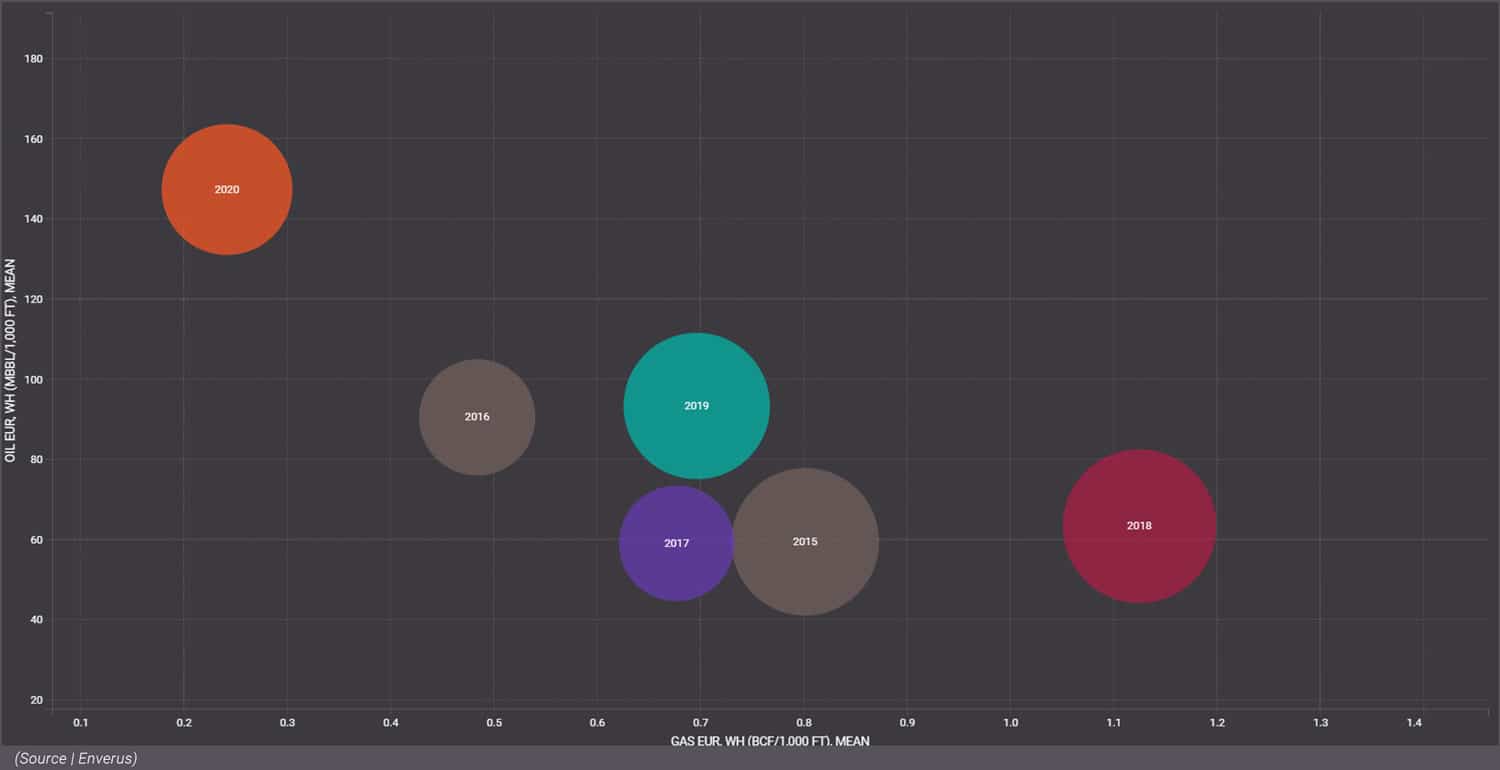

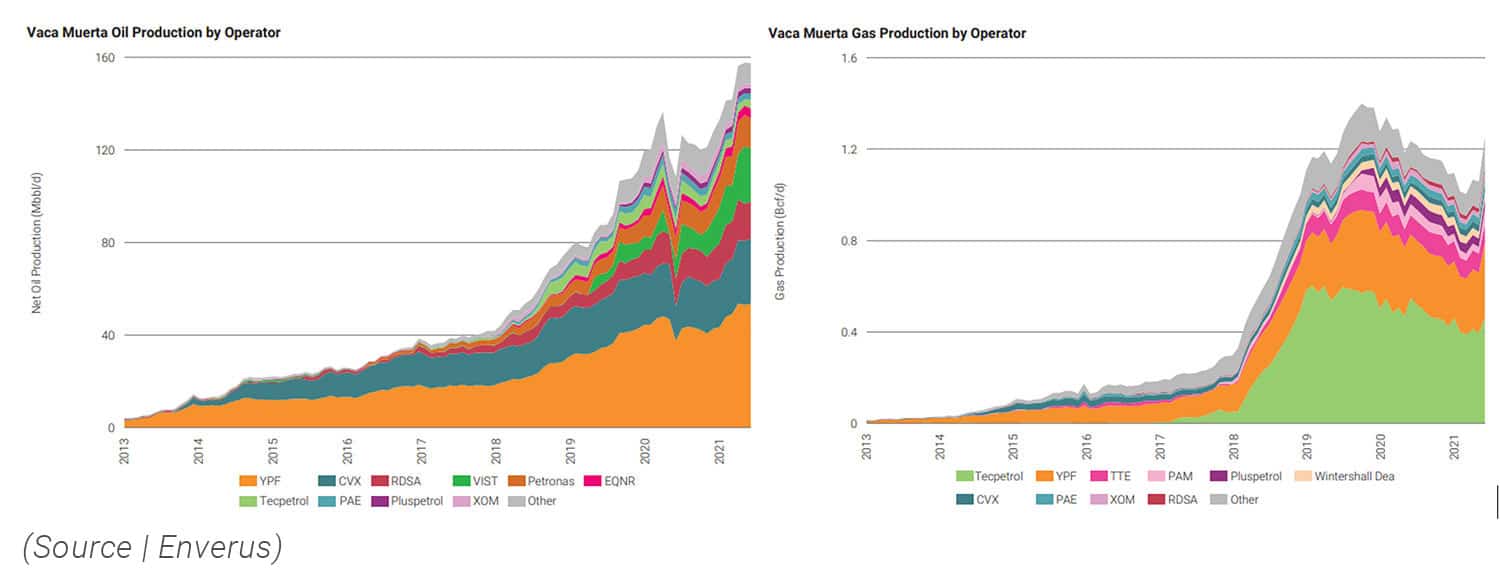

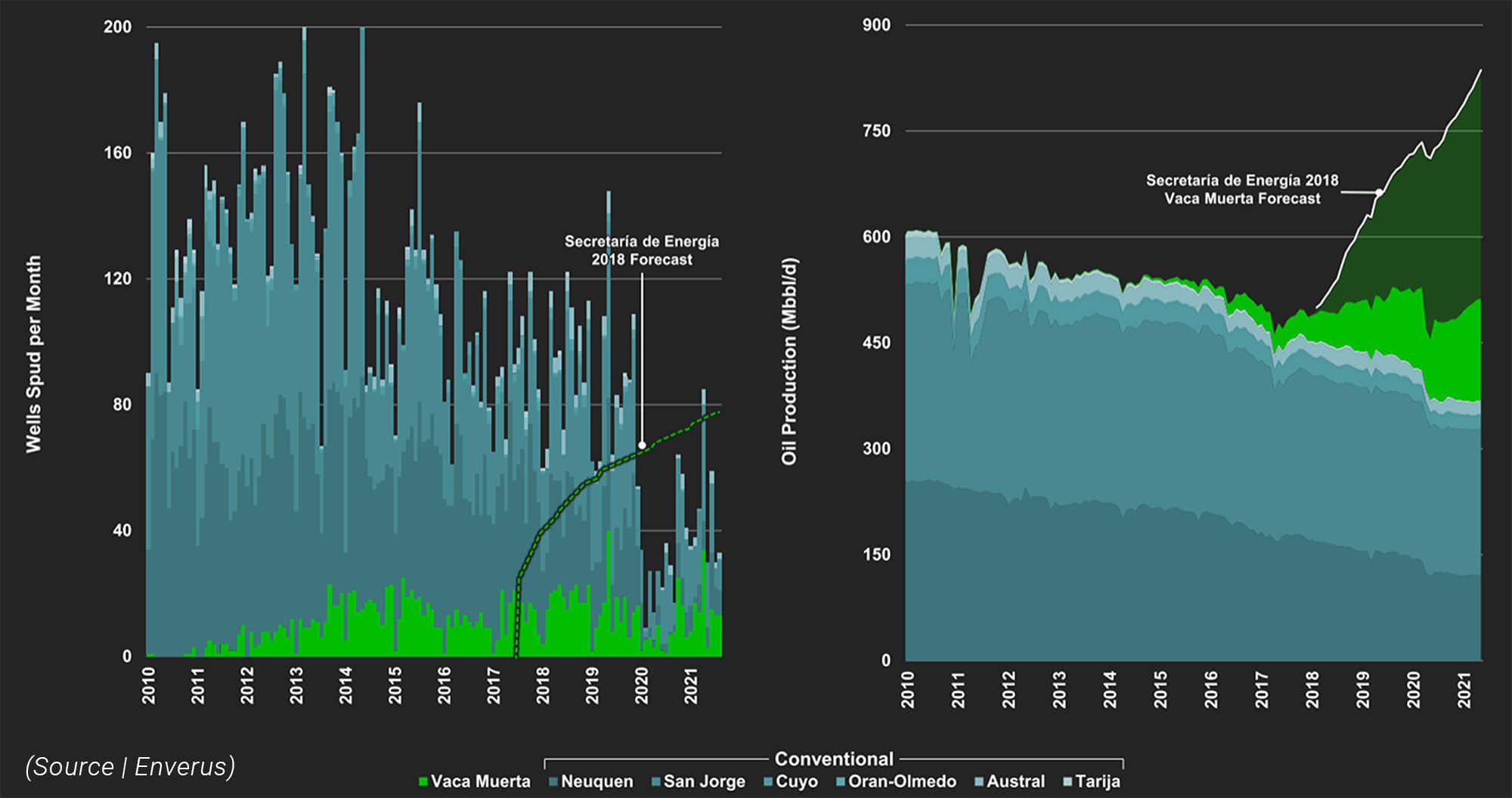

In the last five years, Vaca Muerta oil production focus has been primarily on the oily parts of the play, causing oil production from the basin’s oil wells to surpass 150 Mbbl/d, a staggering 600% increase (Figure 6). In contrast, natural gas production has declined to about 1.2 Bcf/d from a peak of 1.4 Bcf/d in 2019. This pivot away from gassy assets within the basin is due largely to poor local pricing caused by an unsuccessful government subsidy campaign and an ensuing heightened focus by Argentina oil and gas operators on oil developments (Figure 7).

The biggest challenges for Vaca Muerta in its quest to reach forecasted oil production growth targets will be access to markets for both crude oil and LNG exports and attracting the required capital. Despite favorable well performance and economics, current above ground risks – primarily risk from capital controls and other onerous government policies in Argentina. The country is in a state of economic crisis – enough to dissuade investors and limit Argentina oil and gas production in Vaca Muerta.

Sorry, the comment form is closed at this time.