Investment Needs Rise Amid Market Uncertainty

A report by the International Energy Forum and S&P Global Commodity Insights

Executive Summary

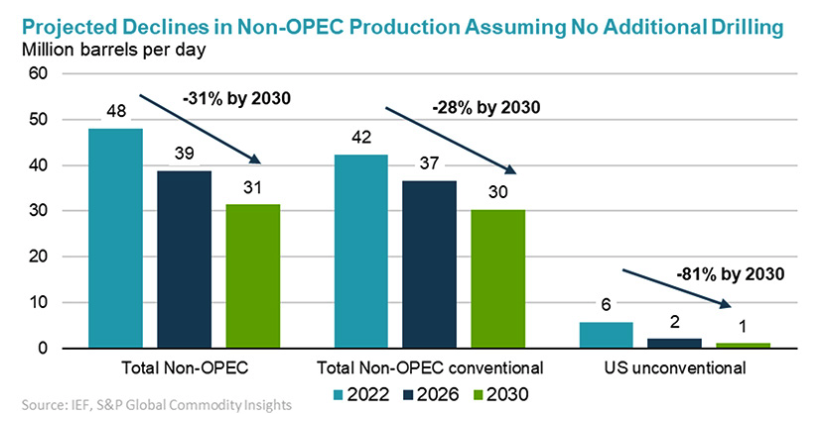

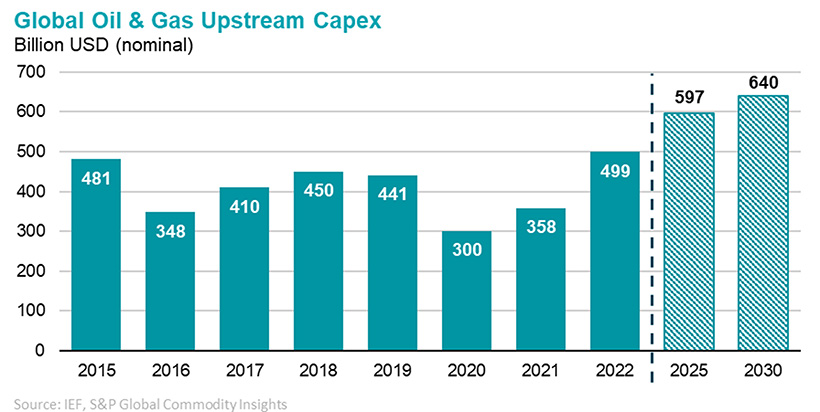

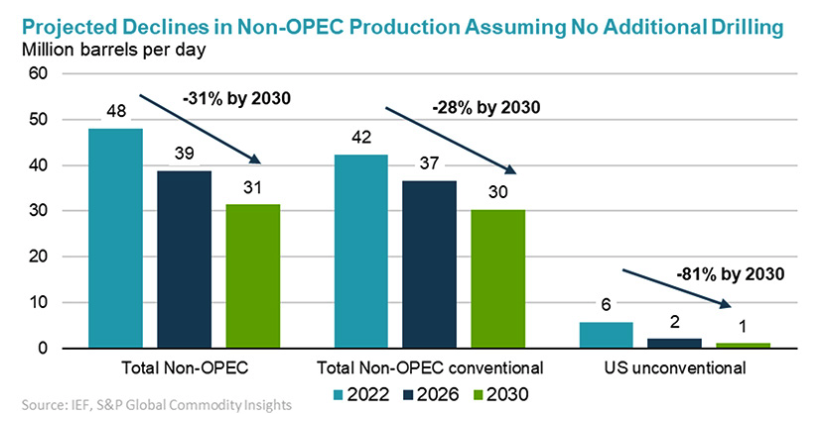

- Oil and gas upstream capital expenditures increased by 39% in 2022 to $499 billion, the highest level since 2014 and the largest year-on-year gain in history. Higher costs primarily drive the increase in investment, but activity has also started to recover. The global rig count is up 22% from a year ago but remains 10% below 2019 levels.

- Annual upstream investment will need to increase from $499 billion in 2022 to $640 billion in 2030 to ensure adequate supplies. This estimate for 2030 is 18% higher than we assessed a year ago primarily because of rising costs. A cumulative $4.9 trillion will be needed between 2023 and 2030 to meet market needs and prevent a supply shortfall, even if demand growth slows toward a plateau.

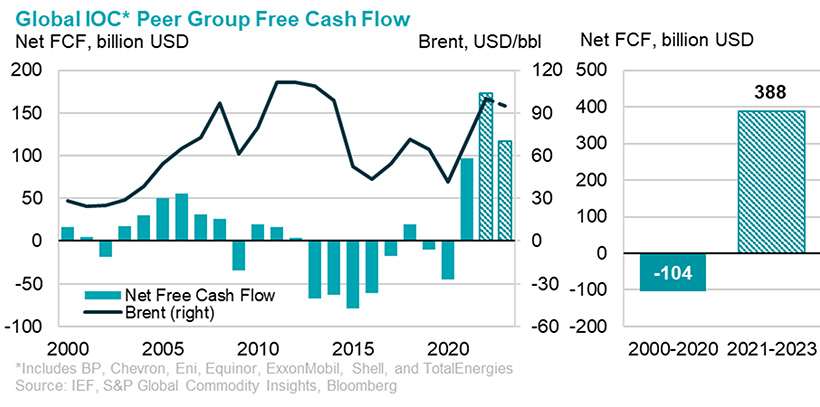

- The major constraint on near-term investment levels has shifted from capital availability to capital allocation. Oil and gas E&Ps are experiencing record profits. While companies prioritize returns to shareholders, share buybacks, and debt repayment, they still have ample free cash flow that could jump-start upstream investment. The question is now, will companies re-invest, and if so, where?

- Near-term economic headwinds weigh heavily on markets and investors. If the world enters a recession in 2023, depending on the duration and depth, it is possible that oil demand growth could remain below trend in the next couple of years, potentially extending the post-pandemic demand stall to five years. Once economic activity recovers, it will likely be less oil demand-intensive than it would have been due to fuel switching, EV penetration, efficiency improvements, and accelerated climate policies. The near-term uncertainty of demand and the potential medium-to-long-term consequences add to investment hurdles and deterrents. However, it also provides a valuable opportunity for upstream investments to catch supply up with demand.

- Energy security has re-emerged as a politically strategic imperative. This has led to increased government interventionism and an important shift away from an energy abundance mindset. Governments and investors can use this as both a warning and an opportunity. The cascading energy crises serve as a warning to the economic turmoil caused by high, volatile energy prices and it is an opportunity to ensure and secure adequate investment for the future.

- Russian production is a big wildcard for the medium-term. There is enormous uncertainty concerning the extent of Russian production losses. Russian production levels depend not only on what sanctions allow and what is technically feasible but also on Russian policy. This decade’s need for investment and new upstream projects will depend on how much Russia produces and invests. This report assumes Russian production will decline by 1.1 million barrels per day in 2023 to 9.4 million barrels per day and then plateau at this level through the rest of the decade.

- The current energy price volatility harms consumers, investors, businesses, and governments. Adequate investment is needed for stable markets now and in the future. If investment falls short, high-prices and high-volatility could become the new standard. Underinvestment threatens to undermine energy security in the short and medium-term and it can also stall progress on climate goals by increasing reliance on more carbon-intensive options in the short-term. The vicious cycle of volatility and investment remains a key risk in the coming decade, with high price volatility deterring investment and lagging investment potentially fueling volatility.

- The energy sector and policymakers can prepare and help mitigate negative impacts by (1) increasing producer-consumer dialogue; (2) bolstering inventories; (3) providing regulatory and policy certainty; (4) supporting long-term contracts; (5) de-risking investments; (6) basing policies on realistic energy demand scenarios; and (7) increasing market transparency.

Key Figures

Figure 1 – Global Oil and Gas Upstream Capex

Figure 2 – Global IOC Peer Group Free Cash Flow

Figure 3 – Projected Declines in Non-OPEC Production Assuming No Additional Drilling

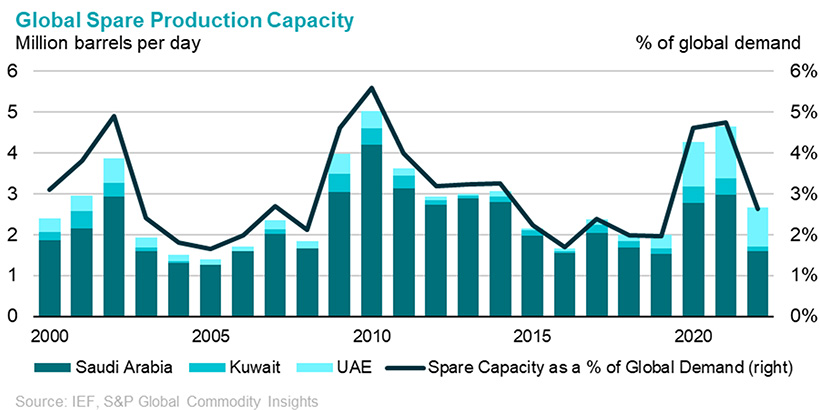

Figure 4 – Global Spare Production Capacity

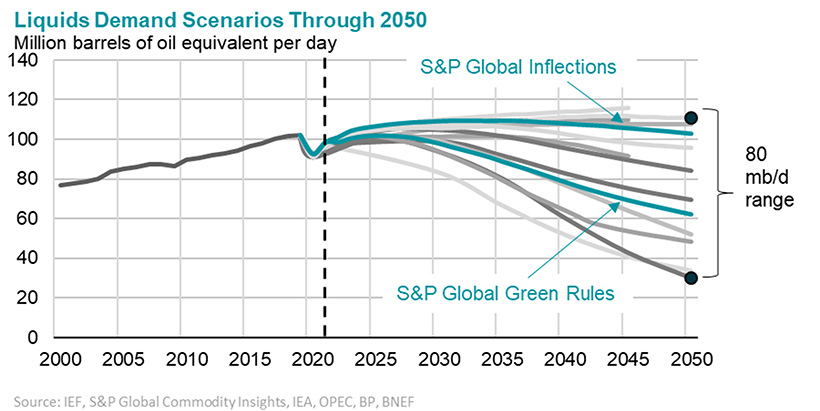

Figure 5 – Liquids Demand Scenarios Through 2050

Sorry, the comment form is closed at this time.