Mexico Oil And Gas Market Size, Share & Trends Analysis

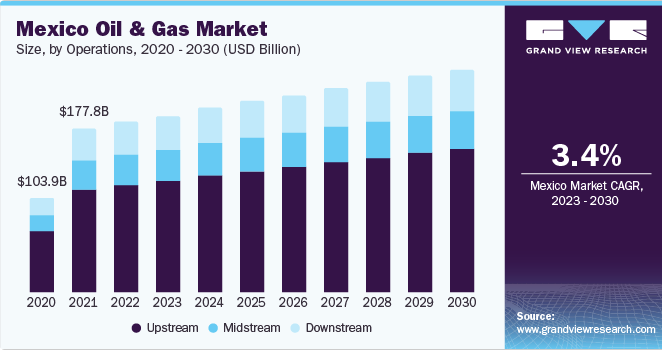

The Mexico oil and gas market size was valued at USD 185.46 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 3.4% from 2023 to 2030. Mexico’s demand for oil & gas is anticipated to increase as a result of government subsidies and the liberalization of fuel prices. Additionally, it is anticipated that cooperation between Mexico and European nations for natural gas trading and the natural gas shortage experienced by European nations due to the conflict in Russia and Ukraine will further influence the oil and gas market’s growth.

Mexico emerged as a potential market for oil and gas in North America in 2022. North America also holds significant reserves of crude oil and natural gas beneath the waters of the Gulf of Mexico and the tight rocks of Alberta, Colorado, Texas, and Central California. Since 2005, an increase in natural gas and crude oil production is being witnessed due to the introduction of horizontal drilling and hydraulic fracturing techniques deployed by oil and gas companies in North America.

The upstream, midstream, and downstream stages make up the value chain for the oil and gas market in Mexico. Exploration, development, production, and decommissioning activities are all part of the upstream stage. Geological surveys, acquisition of land rights, and production activities like on- and offshore drilling are all part of the exploration process. Numerous techniques are used to conduct geological surveys such as seismic imaging for offshore exploration and soil testing for onshore exploration.

One of the commodities that are most frequently traded and consumed around the world is crude oil. The tight rocks of Alberta, Colorado, Texas, and Central California, as well as the waters of the Gulf of Mexico, contain sizeable reserves of crude oil and natural gas.

The COVID-19 pandemic has resulted in hindering the market growth of Mexico’s oil & gas industry owing to factors such as disruption in the supply chain. In March 2020, Mexico saw a sharp decline in oil prices on the market. Due to the economic consequences of the pandemic, there was a sharp decline in oil consumption that caused an oversupply and, as a result, insufficient global storage capacity. On April 20, 2020, the cost of crude oil exported from Mexico fell to a record low of minus USD 2.37 per barrel.

Operations Insights

In terms of revenue, upstream led the operations segment with a market share of 62.75% in 2022. The upstream segment held a sizable portion of the market, and it is anticipated that it will continue to dominate during the forecast period. Oil discovery, extraction, and production are all part of the upstream sector. The midstream sector in the country constitutes 69 natural gas processing facilities throughout 11 natural gas processing centers. The majority of the nation’s natural gas distribution system, which transports processed natural gas to consumption areas, is run by PEMEX.

The downstream sector is made up of oil refineries, distributors, petrochemical plants, and retail stores. As of the end of 2021, Mexico’s six refineries, all run by PEMEX, had a combined refining capacity of 1.6 million b/d. An estimated 38% average refinery utilization rate was recorded in Mexico in 2021. Additionally, PEMEX owns 50% of Texas’s 340,000 b/d Deer Park refinery.

Report Coverage & Deliverables

- Competitive benchmarking

- Historical data & forecasts

- Company revenue shares

- Regional opportunities

- Latest trends & dynamics

Key Companies & Market Share Insights

The market is highly competitive and consolidated due to the presence of a large number of market players. The dominant trend in the operations of these oil & gas companies includes vertical integration which defends against market power and reduces competition. Russia Ukraine war, favorable government regulations, and strong R&D are among the significant factors governing the competitiveness of the Mexican oil & gas industry.

In August 2022, BP p.l.c. announced to consider divesting its oil assets in Mexico and shifting its focus toward renewable energy in Mexico. This business strategy is driven by the growing renewable energy sector in the country and the challenging political environment in Mexico toward the oil & gas sector. Some prominent players in the Mexico oil and gas market includes:

- BP p.l.c.

- Chevron Corporation

- Citla Energy

- Exxon Mobil Corporation

- Marathon Petroleum Corporation

- Petroleos Mexicanos (Pemex)

- SAIPEM SpA

- Sempra

- Shell International B.V.

- TotalEnergies

Mexico Oil And Gas Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Mexico oil and gas market report based on operations:

- Operations Outlook (Revenue, USD Billion, 2018 – 2030)

- Upstream

- Onshore

- Offshore

- Midstream

- Downstream

- Refining

- Upstream

Sorry, the comment form is closed at this time.